A cash flow statement allows a business to monitor and report its income and expenses over a given period. In order to fully grasp this article you need an awareness of the basic business activities (Operating, Investing, and Financing) and the difference between cash inflows and outflows (money coming in versus money going out). Read this PitchLabs article on the importance of cash flow for more background.

While a cash flow statement does show how much the business has profited over a period, it is distinct from other financial statements by detailing the cash movement in and out. A business can be profitable but still face cash flow issues, and vice versa. By reading this article, you’ll know how to prepare a cash flow statement. Then, you can ensure that your business finances are tipping in the right direction. While the steps presented here vary depending on the accounting method used, they capture the essence of the process.

Step 1: Set the Starting Balance

In step one, you’ll need to set the starting balance as well as the cash that’s equal to it at the very start of a period. You’ll find this amount by checking the income statement from that exact period.

This beginning balance is required as you leverage the indirect cash flow coming from operations. With the direct method, on the other hand, you don’t need this data because it is based on the actual cash inflows and outflows. Step 2 talks more about the direct and indirect methods.

Step 2: Work Out Cash Flow from Operations

Whenever you’ve got your balance at the beginning, it’s time to work out cash flow from operations. It’s important to do this so that you know the amount of cash your business has received from its operating activities.

You can work out cash flow from operating activities through one of two methods: direct and indirect methods.

Direct Methods is a very easy-to-follow method of determining cash flow whereby you gather every bit of money from your operations and take away all of the cash disbursements that have come from operations. When using this method, you need to take into account all of the transactions made within a period that has been paid or you’ve become the recipient of.

When using indirect methods, you need to begin with your net statement. You’ll find this on your income statement. Make alterations to ensure you remove the effects of accruals coming from that period. Amortization and depreciation are two of the most popular accruals you’ll need to make changes to.

The direct and indirect methods will both produce identical values. However, the steps taken to work out cash flow coming from operating activities are different.

The direct method might be simpler to interpret. It does however take more time to do so as you need to account for every single transaction that’s made during a given accounting period. The majority of businesses favor the use of the indirect method since it’s quicker and linked closely to the balance sheet. It’s still important to know that General Accepted Accounting Principles (GAAP) does still accept both methods as does the International Financial Reporting Standards (IFRS).

Step 3: Work Out Cash Flow from Investments

Whenever you’ve worked out cash flows from operations, it’s time to work out cash flows from investments. The investments part involves information regarding the buying and selling of assets that are long-term such as equipment, facilities, and property. Bear in mind that debt isn’t included here. Rather, investments include free cash instead.

Step 4: Work Out Cash Flow from Finances

In the next part of the cash flow statement, you must assess both cash inflows as well as outflows pertaining to finances. Involved here are cash flows where the source is equity and debt finances. This includes cash flows relating to raising cash as well as paying off debts to creditors and investors.

By utilizing GAAP, you can pay off dividends. You’ll find this in the operations part of the IFRS. It also involves interests that are paid in the operations part of GAAP and at times under the finances part of the IFRS.

Step 5: Figure Out the End Balance

Finally, whenever you’ve determined the cash flows coming from the three major kinds of activities, you can figure out the end balance of cash as well as cash that’s equal to the finish of that very accounting period.

The alterations in net cash for this period equate to the sum total of cash flows that come from investments, operations, and finances. The total displays how much money was made or lost throughout the period. If you had more money coming into the business than expenses, then your net cash flow is positive. On the other hand, a cash flow that’s in the negative demonstrates that more money lies with expenditure than was made.

Example of a Cash Flow Statement

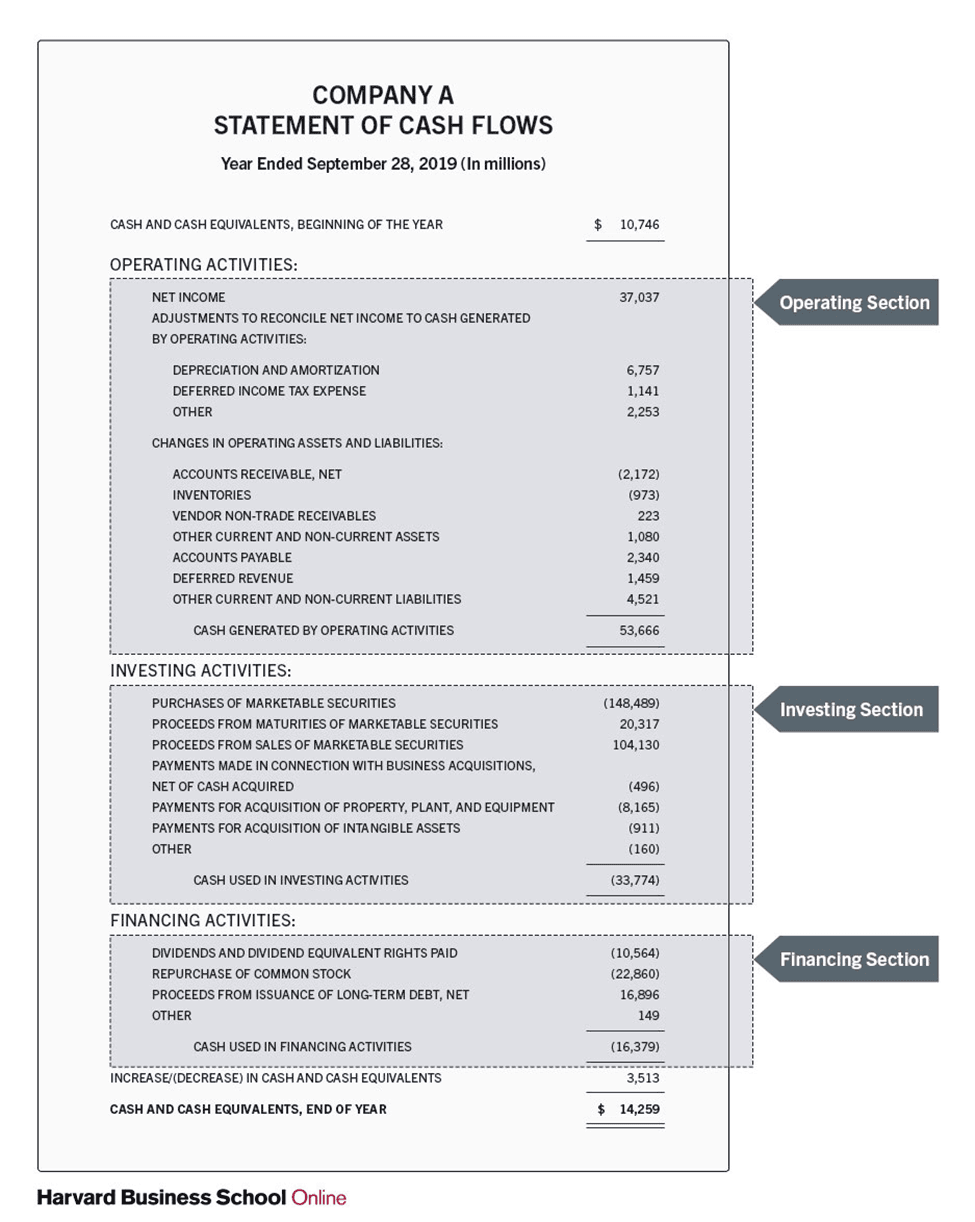

Below is an example of a cash flow statement that’s fictional and uses the indirect method to help you appreciate what actions are taken when creating your cash flow statement.

Image from How to Prepare a Cash Flow Statement | HBS Online

The cash flow statement that you’re looking at reports the accounting period finishing on the 28th of September 2019. You can see at the very top of it that the opening cash and cash equivalents amounted to roughly $10.7 billion.

Throughout the given period, cash that came from operations totaled $53.7 billion. Under the investing activities, you’ll notice that the cash amount was $33.8 billion when you add up all of the investing transactions. Then, the financing activities part displays an amount of $16.3 million in expenses towards actions involving equity and debt finances.

When checking the end of the cash flow statement, you’ll find that the three parts come to a sum of a $3.5 billion increase with the source being cash and cash equivalents throughout the accounting period. Thus, the total number amounts to $14.3 billion.

Conclusion

With a cash flow statement, you can track the income and expenses of your business easily, efficiently, and effectively. Here, we’ve shown you how to create and prepare your cash flow statement. This includes five steps: setting the starting balance and working out cash flow from operations, investments, and finances before figuring out the end balance. Now you know all of the steps required and the parts involved in making up your cash flow statement you can get to work on it so that you can ensure your business finances are clearly set out and you can aim towards success.