Shares & Stockholders – Ownership, Rights, and Responsibilities

A stockholder or shareholder holds shares of a private or public company, thus gaining part ownership of the company.

Stockholders enjoy the benefits of a business’ success in the form of increased financial profits and incentives. On the other hand, the value of their portfolios decline when the company’s stock loses value. Note that stockholders are not personally accountable for the debts and responsibilities of the company. The only financial risk they face is the loss of the money specifically invested in the company.

What are Shares?

Shares are units of stock issued by a corporation that represent ownership. A company can sell shares to investors when it needs to raise money to operate or grow. For example, XYZ company issued stocks and you purchased 20 shares. If each share represents 2% of ownership, you own 20% of the company.

Do Shares Make You Money?

Common shares can make money for a company through capital gains or buybacks. Preferred shares can make money for you through dividends or higher buyback prices.

How Shares are Issued and Regulated

Issuing and allocating shares is a process that ensures transparency and adherence to regulations. Firstly, shares need to be authorized by the company’s board of directors before allocation starts. Issued shares are the number of shares sold to shareholders and counted for ownership purposes. So, a company might have 15 million authorized shares but only issue 10 million.

In some cases, depending on the company’s bylaws or specific circumstances, shareholders’ approval might be required before issuing new shares. This vote ensures existing shareholders have a say in decisions that affect their ownership stake. When shareholders want to increase the number of authorized shares, they meet to discuss the issue and establish an agreement. When they agree, a formal request is made to the state through filing articles of amendment.

For companies going public for the first time with an Initial Public Offering (IPO), an investment bank is typically involved. This is an expensive, highly regulated, and lengthy process in which a company goes through fund-raising phases and scrutiny by regulators. They underwrite the offering, guaranteeing to buy the unsold shares if not purchased by the public.

Investors interested in buying shares can submit a subscription form indicating the number of shares they want to buy. It is now the duty of the company to analyze the subscriptions and decide on the allocation of shares, either by prioritizing certain investor groups or by assigning shares proportionally to subscription requests.

Lastly, companies can buy back previously issued shares from the market and can be reissued later. These are called treasury shares.

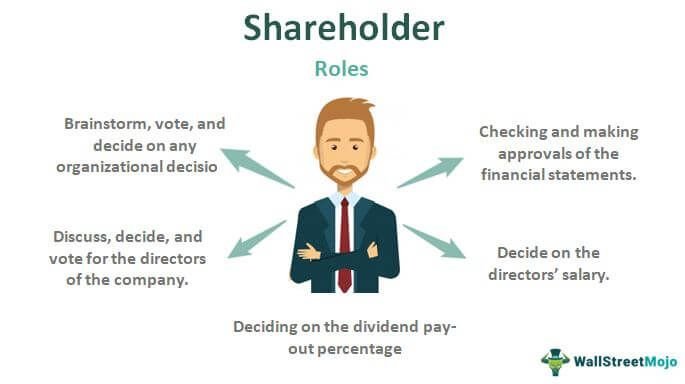

Being a shareholder brings rights and responsibilities as well as tax implications.

Stockholders Rights and Responsibilities

Shareholder rights & responsibilities may vary depending on the firm and individual’s position. The rights include:

1. Profit Potential: Stockholders have the potential to profit when the company performs well. As the company’s stock price increases, they can sell their shares for a gain. They also have the right to claim a proportionate allocation of proceeds if a company liquidates its assets

2. Dividend Distribution: Some companies share their profits with stockholders through dividends. The amount each shareholder receives depends on the number of shares and company’s policy.

3. Voting Rights: Stockholders holding common stock have the right to vote on critical company matters. This can include electing board members, approving major mergers, or changes to company bylaws, through mail-in ballots or online voting platforms if they’re unable to attend voting meetings in person.

4. Oversight: Stockholders have a vested interest in the company’s success and can act as a check on management. By staying informed about the company’s performance and strategy, they can hold management accountable for their decisions. Stockholders can also file derivative lawsuits on behalf of the company if they believe management has acted negligently or fraudulently.

Source: WallStreetMojo

Understanding Stockholder Tax Implications

As a shareholder, celebrating a company’s success goes hand-in-hand with understanding your tax responsibilities. This is how the Internal Revenue Service (IRS) treats your stock market wins and losses:

When you sell your shares for a profit, you’ve achieved a capital gain. This gain is generally considered taxable income. But, if the stock market takes a downturn and you sell your shares for less than you bought them, you’ve incurred a capital loss.

The good news? The IRS allows you to deduct capital losses from your taxable income, potentially lowering your tax bill.

Example: You buy shares of Sunshine Bakery for $50 each but down the road you decide to sell your shares when trading at $30 each. Your capital loss is $20 per share ($50 purchase price – $30 selling price). This capital loss can be used to lower/offset your overall taxable income.

- In another scenario you buy the shares at $50 each and latersell at $90. In this case your capital gain is $40, ($90 selling price – $50 purchase price), which will be taxed as income.

Dividends paid to shareholders must also be reported on one’s tax return as ble income. It is always recommended to consult a tax professional for advice before buying any shares of a company.

Types of Stockholders

- Common stockholder:

A common stockholder has the right to vote for members to sit on the board of directors as well as to influence companies decisions. These stockholders can only receive any dividend payouts after the preferred stockholders have received their dividends.

- Preferred stockholder:

Preferred stockholders receive fixed dividend payments before remaining dividends are distributed among the common stockholders. However, preferred stockholders typically don’t have voting rights. Because of the risk of being at the back of the line to receive dividends or asset payments, new investors feel financially safer purchasing preferred stock but must understand that they will not be entitled to vote on any company actions.

Source: WallstreetMojo

The Difference between a Stock-holder and a Stake-holder

These are two terms commonly used interchangeably but they have different meanings.

A Stockholder as defined above owns shares and has a financial stake in the company’s success whereas a Stakeholder is anyone with an interest in the company’s well-being, which includes employees, customers, suppliers, and the community. Stockholders are a type of stakeholder, but not all stakeholders are stockholders (e.g., employees don’t always own shares).

- Stakeholders do not possess the right to vote, only common stockholders who own stock do.

- Stakeholders are not owners of the business. Only the ones who own shares are owners.

- Stakeholders are not entitled to get a dividend, only those who own shares will get.

Investors and analysts look to several different ratios to determine the net worth and income of a company before investing. Some of these ratios are: Stockholders’ Equity and Agreement.

Stockholders’ equity

Stockholders’ equity refers to the assets remaining in business for shareholders once all liabilities have been settled; that is, the total amount of a company’s total assets and liabilities that appear on its balance sheet. Stockholders’ equity might include common stock, paid-in capital, retained earnings, and treasury stock.

This metric is frequently used by analysts and investors to determine a company’s general financial health. If equity is positive, the company has enough assets to cover its liabilities. A negative stockholders’ equity may indicate an impending bankruptcy and investors consider this unsafe or risky investment.

Stockholders’ equity is an effective metric for determining the net worth of a company, but it should be used in tandem with the analysis of all financial statements, including the balance sheet, income statement, and cash flow statement.

How to calculate stockholders’ equity

Stockholders’ Equity = Total Assets − Total Liabilities

Stockholders’ agreement

Is a legal contract between a company and its stockholders outlining their rights and responsibilities. It can address issues like voting rights, dividend distribution, transfer of shares between stockholders and the treatment of shares if a shareholder dies.

The purpose of a stockholders’s agreement is to protect both the company and its shareholders. It ensures that shareholders are treated fairly, including majority and minority shareholders, it also describes how the company will be operated and how significant decisions will be made.

A shareholders’ agreement is optional. Its contents vary depending on the class of shares and many other factors. Many shareholders’ agreements include competition restrictions and a deed of adherence. The competition and restrictive covenants prevent a shareholder from competing with the company. A deed of adherence ensures new shareholders adhere to the pre-existing shareholders’ agreement

It is pertinent to draft a shareholders’ agreement while starting up the company or issuing the first shares. It helps the investors to reach a common understanding of what they expect to provide to the business and receive from the business.

Bottom Line

Owning shares (stock) makes you a stockholder, a partial owner of a company. This comes with potential profit through rising stock prices or dividends, but also the risk of losing money. Shares are units of ownership companies sell to raise capital. Issuing and allocating shares involves board approval, offerings, and registration.

Stockholders play a vital role in a company’s ecosystem. By understanding their rights, responsibilities, and the various types of stock, investors can navigate the financial markets with greater clarity and make informed decisions about their ownership stake.