Source: iStock

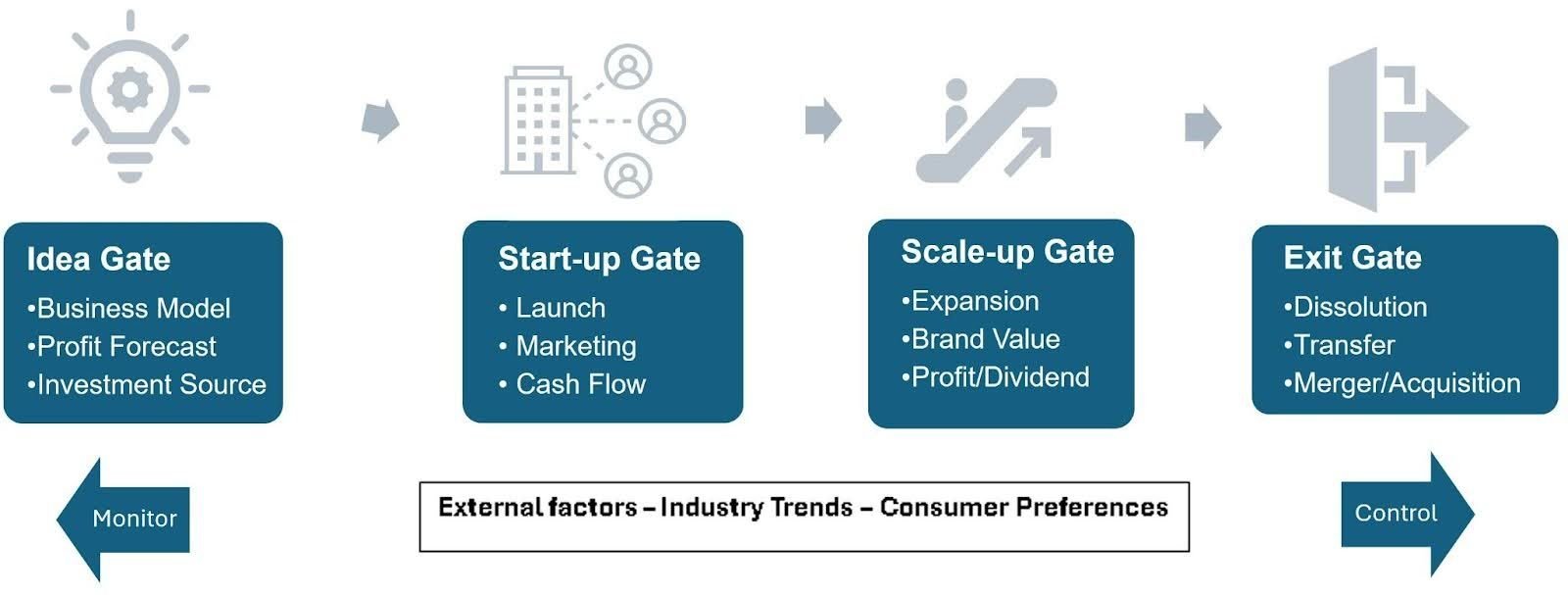

Four-Gate Model of Entrepreneurship

Entrepreneurship can be visualized as a journey with multiple entry/exit checkpoints. The significant milestones in entrepreneurship are envisioned as a four-gate model, as pictured below.

Source: Created by Author

Idea Gate:

“Idea gate” is the first step in entrepreneurship. This starts with getting to know one’s interests and deciding whether entrepreneurship fits their personality. If selecting the entrepreneurial path, the next step is brainstorming and generating ideas capable of deranging the existing business. Ideas can include new products, services, technologies, or innovative business models. When emerging technologies and innovations become critical, disruptive business models gain importance, as there will be a need for new organizational structures for the products and services that emphasize the proposition of a unique value to the market and replace the existing business models. Examples of disruptive innovation include Netflix. Sometimes, it can be an entirely new idea/innovation that opens an entirely new industry, such as the invention of computers.

It is also essential to test the ideas, do a thorough market analysis, make a profit forecast, and get early feedback to ensure the business idea’s viability in the market. A profit/profitability forecast is vital to attracting and convincing potential investors. The profit forecast is a prediction that compares the company’s net turnover with all expenditures, and the resulting number is the company’s operating income before taxes, depreciation, and interest. However, in the case of a start-up, forecasting is a difficult job—there is no history, and everything starts from scratch. One method for constructing the sales forecast is by estimating the revenue components rather than guessing the total numbers. This involves dividing the market into segments, a collection of customers who are expected to behave similarly under similar circumstances, and then estimating the revenue by segment.

Once the ideation stage is over, securing funding is the next to enter the second gate of the entrepreneur’s journey. Diversifying financial sources is a better strategy for meeting specific business needs. Investments can be from equity financing, including personal savings, life insurance policies, home equity loans, venture capital, angel investors, etc., or debt financing from banks, government programs, bonds, or leases.

Start-up Gate:

Once the business concept is finalized and funding sources are identified, entrepreneurs reach the second stage of their journey: the “start-up gate.” Launching a business start-up doesn’t happen overnight. Launching the product/service with a limited budget and mastering the art of selling products to achieve business success take a lot of research and preparation. Cohort analysis can be implemented to get the proper signal while launching the product and correct/adjust the strategies, if needed, to avoid pitfalls. A strategy to form a founding team and day-to-day cash management is also essential. Marketing is vital for start-ups, as spreading word of mouth takes time. Popular marketing strategies include sending emails to potential customers, blogging, social media posts, paid search advertising, and sponsoring relevant events.

Cash flow issues commonly originate from reduced sales, unplanned expenses, seasonality, and late-paying clients. Proper cash flow management can guide a start-up a long way. The following six best practices for cash flow management can help any start-ups thrive.

- Continuous monitoring of cash movements with cash flow statements (cash situation at any point in time) and cash flow forecast (looks ahead to future cash flow based on cash flow statements)

- Ensuring proper customer payments by prompt invoicing and timely communication

- Being vigilant about maturing invoices and taking proper action

- Forming relationships with clients and making sure the checks are processed on time

- Developing a cash reserve to cover expenses for at least a few months in case of a need

- Having a growth strategy and watching the cash flow forecast closely to deal with rapid growth situations

Once these challenges are addressed, the next step is to forge ahead rapidly to advance the start-up business by growing the customer base and revenue. Expanded marketing strategies and enhancement in products/services can make this happen.

Scale-up Gate:

Now that the early days as a start-up have passed and you have succeeded in moving the company forward to its growth stage, it’s time to enter the third phase: the “scale-up gate.” So, how do you know your company is ready to scale up?

According to the Organisation for Economic Co-operation and Development (OECD), “a scale-up business is a company that has seen an average annualized growth of at least 20% over three years with 10 or more employees at the start of the period.” The company has grown in size and complexity, necessitating a more structured, process-oriented approach. In this phase, the company will be ready to experience or is already experiencing an increase in the number of customers and may need to update its payment technology to accommodate the increase in payment volume. With scaling up comes the need for investing in customer experience, not just in products. Initiation of international trade and brand value building are other significant milestones in this phase.

In the scaling-up phase, CEOs or business owners must consider many factors. For instance, a significant mindset shift is needed from “growth for funding” to “growth for sustained sale.” To this end, restructuring the workforce size, composition, and shape may be needed. Leadership capabilities may also need a redefinition with the addition of middle management.

Another common practice for a company at this stage, when it earns an excess profit, is to return dividends to its investors, mostly as cash or sometimes as stocks.

Exit Gate:

Successful start-ups, after growth and scaling, mostly end up at the “exit gate.” Visionary CEOs or business owners plan and have an exit strategy at the beginning, so they will be conscious about generating the right set of conditions for the takeover of their company at some point. That said, an early exit strategy can be vital in getting the most value out of the start-ups during exit. Common exit strategies include mergers and acquisitions, transferring the business to family members, liquidating the assets, and dissolution. One of these can be considered, depending on the company’s goals and conditions. Mergers and acquisitions in which ownership of a business is transferred or combined are important components of business growth and development.

The major motives behind mergers and acquisitions include:

- Gaining control of a competitor’s assets

- A rapid increase in topline revenue through new customer channels

- Utilizing synergy between companies in the same industry

However, a clear understanding of the market and early feedback from potential clients can be vital, as the failure rate with acquisitions is generally high. This shows the importance of end planning right from the start; to paraphrase what Benjamin Franklin said, “If you fail to plan, you plan to fail.”

Conclusion:

The four-gate entrepreneurship model is analyzed in this article, and the significant factors at each stage are explained. External factors such as industry trends and consumer preferences can be common factors in all stages of entrepreneurship and need to be carefully monitored and assessed in each stage.